Curam Team

December 18, 2020

Each year billions of pounds of benefits go unclaimed in the UK, but navigating your way through the maze of what's available is easier said than done. Let us walk you through where to start with understanding government benefits including:

· How much you can potentially receive

· Eligibility requirements

· How to claim

· Other key information

We also provide links to relevant pages on the Government website, so you can find out more and start claiming.

Low IncomeBenefits:

Benefits for the elderly:

Heating Benefits:

Disability and Ill Health Benefits:

· Personal Independence Payment (PIP)

· Disability Living Allowance for Children (DLA)

What is the Attendance Allowance?

The Attendance Allowance is a benefit for people over the State Pension age who need help with personal care or supervision because of a physical/mental disability or terminal illness.

How much you can potentially receive:

· You could be eligible to receive £59.70 or £89.15 per week, depending on the level of help you need

Eligibility:

· You must be over state pension age and need help with personal care or supervision because of a physical/mental disability or terminal illness.

· This benefit is tax-free, not means tested, and it will not affect most other benefits you may receive.

How to claim:

· Apply for this benefit using the Attendance Allowance helpline: 0800 731 0122 (textphone 0800 731 0317) or download the claim form.

Other key information:

· The money doesn’t have to be spent on a carer – it could be put towards something that can make your life more independent for longer (e.g. a stair lift).

· If you’re eligible for Attendance Allowance, you may gain access to other benefits, such as Pension Credit, Housing Benefit or Council Tax Reduction, or an increase in those benefits if you’re already receiving them.

Return to Benefits MenuWhat are Bereavement Benefits?

Someone can claim bereavement benefits if their spouse or partner has died, and they need help to cope with financial worries. The bereavement support payment (BSP) is a benefit that is available to anyone whose partner has died in the last 21 months. This benefit used to be called the Widow’s Pension.

How much you can potentially receive:

If you claim for bereavement support payment within 3 months of a spouse’s death, you can receive the full amount. If you claim for BSP within 21 months of a partner’s death you will get fewer payments, but you will still get some monthly payments.

· If you are entitled to the higher rate of BSP you could receive a single payment of £3500 then up to 18 monthly payments of £350.

Eligibility:

· This benefit is not means tested (not based on a person’s financial situation).

· The deceased must have been under the State Pension age and have been living in the UK or a country where this BSP is available.

A widow or widower can claim for bereavement support payment if:

· Their late partner paid National Insurance for 25 weeks of a single tax year.

· Their partner or spouse died due to a disease caused by work, or an accident that happened at work.

Someone is eligible for the higher rate of bereavement support payment if:

· They are entitled to Child Benefit or they were pregnant when their partner died.

How to claim:

· Apply by phone by contacting the Bereavement Service helpline – 0800 731 0469.

· Download and fill in a Bereavement Support Payment form and send it to the address listed on the government website.

Other key information:

· If a partner died over 21 months ago you may still be able to claim for bereavement benefits if the cause of death was confirmed longer than 21 months after the death.

· The Widowed Parent’s allowance may be available to someone if their partner died before 6 April 2017.

Return to Benefits MenuWhat is the Disability Living Allowance for Children (DLA)?

The Disability Living Allowance is a tax-free benefit to help with the additional cost of looking after children under 16 years old who have difficulties walking or who need higher levels of care than a child of the same age who does not have a disability.

*The Disability Living Allowance for Adults has now changed to the Personal Independence Payment.*

How much you can potentially receive:

· You could receive between £23.60 and £151.40 per week depending on the level of looking after that the child needs

Eligibility:

· To claim for a child you must be their parent or guardian (this includes grandparents, foster-parents, step-parents, guardians, or older siblings)

· For more information on eligibility click here

How to claim:

· To claim: either print off and fill in the DLA Claim Form, or phone the DLA helpline: 0800 121 4600 and ask to be sent a printed form.

Other key information:

· You will be able to be paid starting from your claim’s start date.

· Back-paying is not possible.

· You will receive a decision letter usually about 8 weeks after your claim form has been received, from then onwards the DLA is usually paid every 4 weeks on a Tuesday.

Return to Benefits MenuWhat is the Carer’s Allowance?

The Carer’s Allowance is a benefit for informal carers who spend at least 35 hours a week caring for someone. This care can include physical, practical and domestic support, and emotional and virtual (over the phone or online) support during the Covid-19 crisis.

How much you can potentially receive:

· You could receive up to £67.25 per week – depending on the benefits your care recipient receives.

Eligibility:

· You must spend at least 35 hours a week caring for someone.

· You must be an adult who earns £128 or less a week after tax, National Insurance and expenses.

· As well as certain other requirements.

How to claim:

· Apply for this benefit over the phone on 0800 731 0297, on the Government website or by post.

Other key information:

· The money received is to spend as you see fit.

· Each week you claim the Carer’s Allowance, you will also automatically receive National Insurance Credits.

Return to Benefits MenuCold Weather Payment:

The Cold Weather Payment is a benefit that you can receive (depending on certain other benefits) if the weather in your area of the UK is very cold and you are on a low income.

How much you can potentially receive:

· You get £25 for each 7-day period of very cold weather between 1 November and 31 March.

Eligibility:

· Very cold weather: if the average temperature in your area is recorded as, or forecast to be, 0°celsius or below over 7 consecutive days.

· You are able to check if your area is due a payment in November each year.

· This is a means-tested low-income benefit, check your eligibility here

How to claim:

· You do not need to claim, if you are eligible you will receive this payment automatically.

Other key information:

· If you do not receive this payment when you think that you should have, get in touch with your pension centre or Jobcentreplus office to make a claim.

How do I get a Council Tax Reduction?

Council Tax Reduction, also known as Council Tax Support is a benefit that helps people on lower incomes, or those who claim certain benefits, to minimise their outgoings and pay their Council Tax bill.

How much you can potentially receive:

· The amount you could receive depends on many factors (benefits, age, income, savings, shared home, cost of Council Tax).

· The amount also differs depending on your Local Authority.

· It may be a percentage discount off your total bill, a set amount discounted or even a discount of the whole amount.

Eligibility:

· You must be on a low income and have less than £16000 in savings, as the assessment is means-tested.

· You can claim a reduction regardless of whether you are working or unemployed, or a homeowner or not.

· People who are severely mentally impaired do not have to pay Council Tax and full-time students can also claim a discounted rate.

How to claim:

· Apply here to find out how much you can save within your Local Authority.

Other key information:

· The property for which you are claiming the reduction must be your main or only residence.

Return to Benefits MenuHow to challenge a Benefits Decision

If you would like to challenge a decision on any of these benefits, you can apply for a reconsideration or an explanation of why your previous application was rejected, this is called a Mandatory Reconsideration.

Eligibility:

· You believe that the office dealing with your claim has made an administrative mistake and/or left out significant evidence

· You disagree with the given reasons for the office’s first decision

· You simply want the decision to be looked at again

How to claim:

· Explain in writing why you believe the decision to be wrong

· Send this, along with any evidence, to the address that is on your original decision letter.

What is the Employment and Support Allowance?

The Employment and Support Allowance (ESA)is a benefit that helps people who are unable to work because of a disability or health condition. It provides financial support as well as guidance on how to get back to work if that is a possibility.

*You are also able to apply for this benefit if you are unable to work due to COVID19, in certain situations where you are ‘shielding’ or ‘self-isolating’.*

How much you can potentially receive:

· While you are being assessed (13-week period) you can claim:

· Up to £58.90 per week (under 25s)

· Up to £74.35 per week (over 25s, below 65s)

· After the assessment you will be placed in 2 different groups:

· Work-related activity group (if you are potentially able to work in the future) - earning up to £74.35 per week

· Support group (no possibility of working again) - earning up to £113.55 per week

Eligibility:

· You must be under state pension age to apply

· You must have a health condition or disability that prevents you from working full time

· You can work up to 16 hours a week/earn up to £140 a week while you claim this allowance, under these conditions.

How to claim:

· For more information on eligibility and how to claim, visit the ESA .gov website page

Other key information:

· This benefit is incompatible with Jobseekers Allowance and Statutory Sick Pay

Return to Benefits MenuWhat is the Furlough Scheme?

Being ‘on furlough’ means that someone is kept on the payroll even if they cannot work, have less work or no work due to the coronavirus pandemic. The Coronavirus Job Retention Scheme helps an employer to pay someone that is on furlough.

How much you can potentially receive:

· You could be paid up to 80% of your normal wages, up to £2500 a month.

Eligibility:

· If you are not able to work as a result of the Coronavirus pandemic and your employer has agreed to keep you on the payroll, you are entitled to furlough.

· If someone is sick or self-isolating, they are eligible for furlough.

· If someone is extremely vulnerable to coronavirus due to an illness they are eligible for furlough.

· If someone is unable to work due to care responsibilities at home that have been caused by the coronavirus, they are eligible for furlough.

How to claim:

· Your employer must claim furlough through the Coronavirus Job Retention Scheme.

Other key information:

· On furlough, you will be paid by your employer and you will still pay taxes.

· An employer can choose to put someone on full furlough or flexible furlough

· You cannot work for your employer during the time you are on full furlough.

· If you have lost some of your income due to the coronavirus and you are on furlough, you may also be eligible for universal credit.

Return to Benefits MenuWhat is a Non-Means-Tested Benefit ?

If a benefit is non-means tested, it means that someone can be eligible for it no matter what their financial situation looks like. If a benefit is means-tested it means that the amount of money a person is entitled to depends on how much their income, property and other assets amount to. If someone has a stronger financial situation and their income is high, they are unlikely to receive benefits that are means-tested. However, a person with a better financial situation can still be eligible for some benefits that are non-means-tested.

Return to Benefits MenuWhat is a Pension Credit?

Pension Credit is a benefit for people who are State Pension age or older. It tops up your income if you are struggling financially

How much you can potentially receive:

· Pension Credit comes in 2 parts:

· Guarantee Credit tops up your weekly income, so it reaches a guaranteed minimum level: £173.75 if you're single or £265.20 if you're a couple.

· Savings Credit is additional funding if you have some savings or if you earn more than the basic State Pension. As a single person, you could get up to £13.97 extra per week, or if you're a couple, up to £15.62 per week.

· Use the Government’s Pension Credit Calculator to find out how much you can claim.

Eligibility:

· You are only able to claim Savings Credit if you reached State Pension age before the 6th April 2016.

· You are also eligible if you are above state pension age and are a carer, have a severe disability or continue to pay housing costs (e.g. mortgage), even if your income is above the upper limit.

· There is no savings limit, yet savings over £10,000 may affect your application.

How to claim:

· Apply for this benefit over the phone on 0800 731 0297 or on the Government website by clicking here, or by post by printing out this form.

Other key information:

· You might also gain access to other benefits if you receive Pension Credit (such as Reduced Council Tax, Cold Weather Payments and more).

· It is possible to claim even if you are still working.

· It is available to both single pensioners and pensioners in couples.

Return to Benefits MenuWhat is the Personal Independence Payment (PIP)?

The Personal Independence Payment is a benefit for adults aged from 16 to state pension age who have a long-term illness or disability. It is designed to help with the extra costs associated with having such conditions. It is the replacement for the previous Disability Living Allowance for Adults benefit.

How much you can potentially receive:

· You could receive between £23.60 and £151.40 a week

· The different rates are:

· £57.30/week (Standard Payment)

· £85.60/week if you have a more serious illness (Enhanced Payment)

· If you have mobility issues, you could also receive:

· £22.65/week extra (Standard Mobility Payment)

· £59.75/week extra (Enhanced Mobility Payment)

Eligibility:

· You must be between 16 years old and state pension age.

· You must also have a disability or health condition that causes you to:

· Struggle with day-to-day tasks and/or mobility for 3 months

· Anticipate a further 9 months of these difficulties

· The amount you receive changes depending on how your condition affects your daily life, not because of which condition you have.

How to claim:

· Make a claim by telephone: 0800 917 2222, by textphone: 0800 917 7777. If you need help with the call, you will find more information here

· Once you have filed a claim, you will need to fill out a ‘how your disability affects you’ form

Other key information:

· The process can be fast-tracked if you are terminally ill

· Visit Citizen’s Advice Website if you need help with your claim or with filling out this form

· Your condition will then be regularly reviewed to ensure that you are receiving the right level of support

Return to Benefits MenuHow do I claim Statutory Sick Pay?

Statutory Sick Pay (SSP) is a benefit that is paid if you have to take time off work due to ill health. You cannot claim SSP if you are self-employed, please look below for alternatives.

How much you can potentially receive:

· You can claim a minimum of £95.85 per week, often more if your employer has a Sick Pay Scheme

· The amount is paid into your account by your employer for up to a maximum of 28 weeks

· Tax and National Insurance are deducted

Eligibility:

· You can get this benefit starting from the 4th day that you are off work sick

· If you are self-employed you cannot claim SSP, however you may qualify for the Employment and Support Allowance

How to claim:

· To claim, tell your employer that you are unable to work before the deadline that they have set (if they haven’t set one, tell them within 7 days)

Other key information:

· Coronavirus: you could get SSP if you are self-isolating or shielding due to COVID19, paid for every day taken off work (if you have been off for more than 4 days total)

Return to Benefits MenuWhat is Universal Credit?

Universal Credit is a benefit that helps people with their living costs. It is a monthly payment for people who cannot get work, are out of work or are on a low income.

How much can you potentially receive:

· The Universal Credit standard allowance for people over 25 is £409.89

· If you are in a couple, or under 25 this amount will be different.

Some of the extra payments related to care include:

· If you have a disability or health condition you could receive up to £341.92 on top of the standard Universal Credit allowance

· If you have a severely disabled child you could receive up to £400.29 on top of the standard allowance

· If you care for a severely disabled person you could receive up to £162.92 on top of the standard Universal Credit allowance

· You could earn up to £1108.04 if you need help with childcare costs

Eligibility:

· You must be 18 or over (some 16 and 17-year-olds can still claim Universal Credit)

· You or your partner must be under the State Pension age and you must live in the UK

· You and your partner must have less than £16,000 in savings

How to claim:

· You can apply for Universal Credit online.

Other key information:

· If you receive tax credits, they will stop when you apply for Universal Credit

Return to Benefits MenuWhat is the War Widow(er) Pension?

If someone’s wife, husband or civil partner dies as a result of working in Her Majesty’s Armed Forces or during a war, their spouse or partner can claim the War Widow(er) Pension.

How much you can potentially receive:

· The amount of money someone is entitled to as War Widow’s or Widower’s Pension depends on someone’s age and circumstances.

Eligibility:

· Someone must have served in the Armed Forces before 6 April 2005, but they could have died of an injury or illness after this date.

· There are other circumstances whereby someone is entitled to the War Widow(er) Pension due to a death within the Armed Forces or during times of war.

How to claim:

· You can apply for the War Widow(er) Pension by downloading a claim form and sending it to the Veterans UK address listed on the government website.

Other key information:

· You may also be eligible for a grant of up to £2200 for a veteran’s funeral.

· You can appeal the decision made about your claim for the War Widow(er)’s Pension.

Return to Benefits MenuWhat is the Warm Home Discount Scheme?

The Warm Home Discount Scheme is a benefit that gives you a one-off discount on your electricity bill for the winter period between September and March.

How much you can potentially receive:

· You could get around £140 off your bill each winter (the amount changes annually

· The money is directly discounted from your electricity bill

Eligibility:

· There are 2 ways to qualify for the discount:

· If you get the Guarantee Credit element of Pension Credit (AKA ‘core group’)

· If you are on a low income and meet your energy supplier’s criteria for the scheme (AKA ‘broader group’)

· You are eligible if you use pre-pay, pay-as-you-go, as well as pay monthly.

How to claim:

· To apply, check whether you are eligible with your energy supplier and apply through their website.

· Check your eligibility as early as possible, as the number of discounts that can be given out are limited.

Other key information:

· This discount does not affect the Cold Weather Payment or the Winter Fuel Payment benefits

Return to Benefits MenuWhat is the Winter Fuel Payment?

This benefit is an annual tax-free payment for the elderly to help with heating costs in the winter.

How much you can potentially receive:

· The amount paid changes yearly, for the financial year 2020-2021:

· £300 for those over 80 years old

· £200 for those between the cut off age and 80

· However, you will receive less if you live with others who qualify for the payment, find out more here.

Eligibility:

· You must be born on or before a certain date (that changes yearly) to be eligible for this benefit.

· The payment is not means-tested.

· You are eligible if you lived in the UK for at least one day of the qualifying week(which changes yearly).

How to claim:

· If you have never claimed the payment before, call the Winter Fuel Payment helpline on 0800 731 0160 to make a claim.

· If you have claimed previously, the payment is made automatically every year (if your circumstances do not change).

Other key information:

· If you do not receive your payment or if your circumstances change, contact the Winter Fuel Payment Centre by telephone: 0800 731 0160, or through their online enquiry form.

Return to Benefits Menu

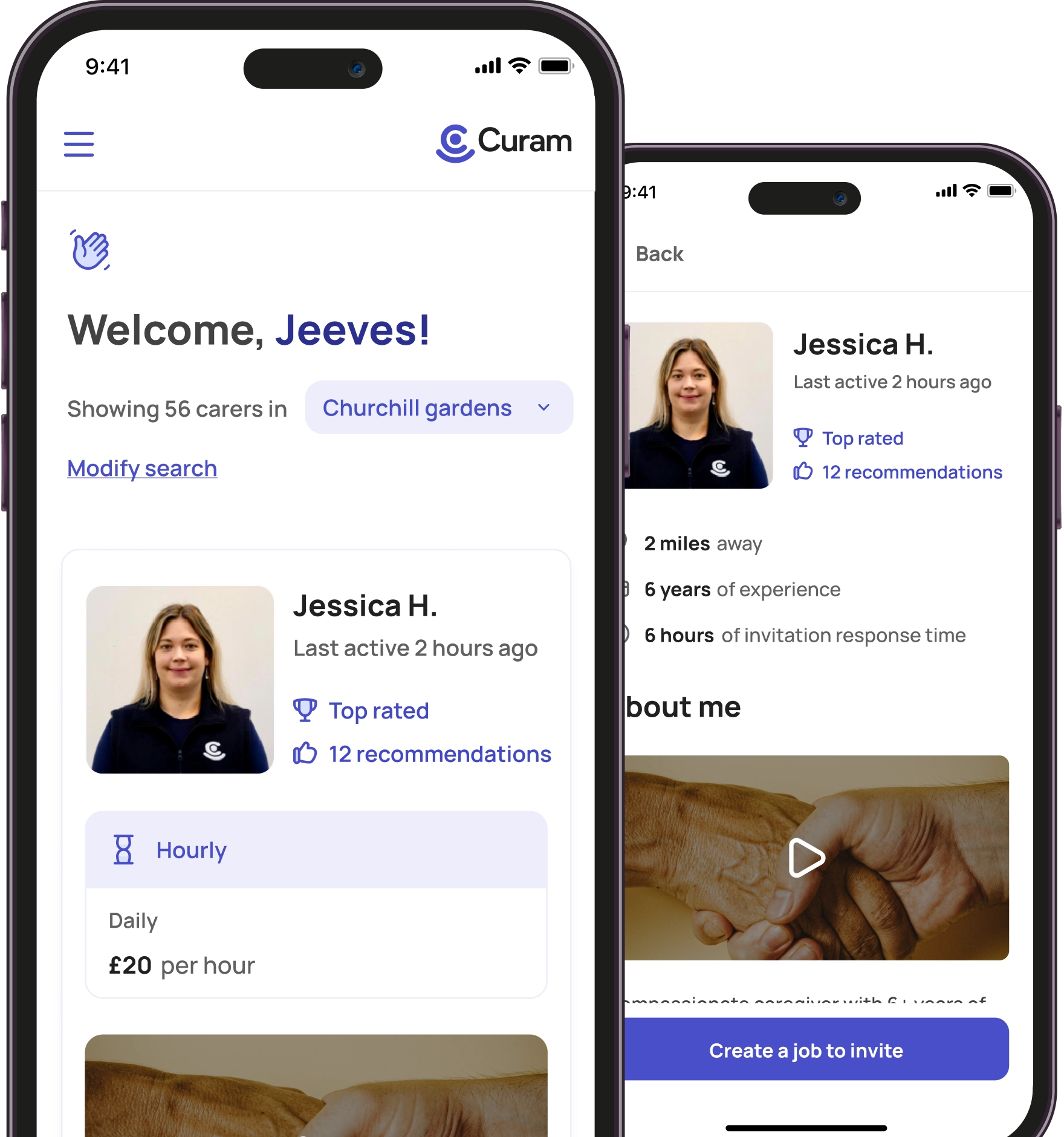

Vetted & approved carers

Vetted & approved carers

DBS checked & insured

DBS checked & insured

Back

Back